Blog

Exhibitor Profiles

Inside Allied Grape Growers: President Jeff Bitter on Cooperative Advantages and Industry Stability

Exploring the Advantages of a Grower-Owned Cooperative and Its Role in Sustaining the California Wine Industry

In the dynamic and often unpredictable world of winegrape growing, stability and fair representation are crucial for success. Allied Grape Growers (AGG), a grower-owned cooperative, has been a cornerstone of the California wine industry, providing its members with a reliable platform for marketing their grapes and ensuring that their voices are heard. This cooperative model not only benefits individual growers by returning profits and limiting unnecessary costs but also contributes to the overall stability and sustainability of the industry. Operating as a cooperative, Allied Grape Growers returns profits to its members, ensuring their interests are prioritized in every transaction. In an exclusive interview with Jeff Bitter, President of the Allied Grape Growers, we explore how this cooperative model benefits growers and contributes to the overall stability of the wine industry, as well as the challenges and innovations shaping its future.

Allied Grape Growers operates as a cooperative, returning profits to its grower members. How does this model benefit growers, and how does it contribute to the overall stability of the industry?

The benefit of the cooperative model for growers is that they can be assured those selling their grapes are truly representing them in the transaction. It also limits the growers’ cost to that which is necessary to effectively market their grapes. Since AGG is grower-owned, any profits that are earned above cost are returned to the members, so there are no excess marketing fees paid by growers. Having a grower-owned and operated marketing cooperative also provides stability to the industry by making sure the growers’ interests and voices are heard. AGG has decades-long relationships with many in the industry, providing stability and also opportunity. Most growers have exposure to only a few grape buyers. AGG brings the opportunity to connect with hundreds of buyers statewide.

Image: Team of Allied Grape Growers

How are changing consumer attitudes and preferences impacting the demand for California wine, and how should the industry respond to these trends?

We’ve experienced shrinking demand for our product over the last two years, for numerous reasons. Since there is no single cause of waning demand, our industry has to respond to these trends from all angles. We cannot focus on just one response. Our headwinds and challenges are diverse and numerous. Some of those headwinds require quick supply-side responses (like the removal of excess vineyard acreage), and some require longer-term investment in demand-side responses (like meeting the new generation of consumers where they are and not trying to force them to adopt wine’s historical appeal). Further necessary industry responses come from advocacy and promotion of our product. This requires players in our industry to work together and manage the temptation to act only in the interest of self. Unified messaging and response are critical for our industry to move forward.

How important are innovation and adaptation in the face of changing market conditions, and what are some examples of how growers are innovating in their vineyard practices and business models?

Innovation and adaptation are a necessity. In the grape-growing business, there is no economic room for error. It’s a very low-margin business with incredible price pressures from the marketplace, coupled with ever-rising costs. Cost increases are being driven by policy and mandates that growers have little or no control over, and they largely center around labor. The more growers can do to eliminate reliance on labor and reduce costs by mechanization and automation, the better. We continue to see advances in automated equipment, and I believe with the explosive advances in artificial intelligence (AI), we are going to have many opportunities to address economic issues in the near future. Regarding business models, grape-growing has become something one does only with a reliable buyer/partner for your product. Long gone are the days of growing grapes on speculation from year to year, without assurance of an end destination or a longer-term marketing plan. As the market experienced growth in the last three decades, growers generally had choices in terms of who to sell their grapes to from year to year. Often, there were multiple suitors for their product. With the mature (flattening) market of the last few years, it is much less common to have multiple opportunities. The risk is too high and the investment is too heavy to grow grapes now without assurance of a home for the product. I don’t necessarily know if I would call this “innovation”, but it certainly represents a change in the business model.

Image: AGG President Jeff Bitter at the Suisun Valley Growers meeting

You've emphasized the need to remove 50,000 acres of wine grapes in California to balance supply with decreasing market demand. Could you elaborate on the current state of the market and the factors driving this oversupply?

The state of the market has not changed since I originally made that statement earlier this year. Inventories remain backed up at retail, wholesale, and production. Many factors have caused slowing movement throughout the supply chain, and it’s being experienced within alcoholic beverage categories beyond wine. The reality is that our industry has been structurally oversupplied since 2018. This, in part, has been due to a lack of vineyard removals in recent years. The short crops of 2020, 2021, and 2022 masked the state’s underlying production capacity. The short crops also contributed to healthier markets in those years, which discouraged removals from an economic perspective. The bottom line is that now we have some catching up to do on acreage removals.

You've suggested that growers need to remove older vines and less desirable varieties to reduce acreage. What are the barriers to achieving this reduction, and how can the industry incentivize growers to make these changes?

The barriers to vineyard removal are disappearing. Simply economics will force aged and less desirable vineyards to be removed. From a practical perspective, as multi-year contracts expire (which normally have price supports of some kind), more and more growers will be subject to spot market pricing. Obviously, this doesn’t happen in one year, so it takes time for the effects of a down market to manifest itself across a broad range of growers. Challenging economics are clearly a strong incentive to remove unprofitable vineyards, but growers can be incentivized to re-purpose their land for other uses like alternative crops or even soil health and land restoration programs. There are other, more subtle, barriers to vineyard removal including things like water rights preservation, ag burning prohibitions/restrictions, and concerns over asset valuation.

Image: These 24-year-old District 13 Cabernet Sauvignon vines are being removed due to both tonnage reductions and price/ton constraints.

What are some of the biggest challenges facing California winegrape growers today, and how is Allied Grape Growers working to address these challenges?

The two biggest challenges facing California winegrape growers today are:

1) Our legislative and policy environment in California and

2) Shifting demand for our end product (wine).

Allied Grape Growers is actively involved in industry efforts aimed at addressing these issues by being on numerous boards and task forces. Allied Grape Growers has spent many years supporting efforts to advocate on behalf of California Winegrape Growers by being intimately connected and involved with the California Association of Winegrape Growers (CAWG). Additionally, we have provided free and useful supply-side production data and forecasting for those in our industry to make better business decisions. Allied Grape Growers and CAWG are the only two statewide winegrape grower organizations providing a voice for California growers.

What steps do you believe are necessary to ensure the long-term sustainability of the California wine industry, both in terms of environmental practices and economic viability?

The first step is for our industry to achieve a supply/demand balance. If we don’t have economic sustainability, we don’t have sustainability at all. And it is hard or even impossible to have economic sustainability with chronic oversupply. That means we have to be responsive to market signals and demand trends and adjust supply as necessary. I am not promoting supply reduction as the only way to achieve economic sustainability, but it is, undisputably, the fastest way to achieve it, given our current oversupply situation. There are avenues to pursue economic sustainability through supply/demand balance by focusing on increasing demand as well, but let’s be real and admit that isn’t going to happen overnight (unless perhaps, we have another “French Paradox”). We also have to be given the chance to operate on a level playing field with foreign competition. Currently, this is not the case, as millions of gallons of wine flow into this country annually at price levels which would not be considered economically sustainable for California growers. Many of those countries do not have the same production cost structure that we do. In some cases their governments offer subsidies and marketing dollars to enhance sales. As an industry, we also need to find creative ways to market our product in response to neo-prohibitionism. Any movement toward the notion that any amount of alcohol is bad for a person needs to be countered with the facts surrounding consumption in moderation. If our industry allows exaggerated negative messaging to influence the consumer, our sustainability will be compromised.

Regarding environmental practices, I believe the wine industry sets the standard for practicing environmentally sustainable practices. From the creation of the California Sustainable Winegrowing Alliance in the early 2000s to the fact that winegrapes have one of the lowest rates of water use per acre amongst California’s permanent crops, we have a whole range of practices and facts that substantiate our environmental sustainability. As we further adopt sustainable practices and improve our operations, we will continue to ensure the long-term sustainability of the California wine industry from an environmental perspective. This includes the continual development and adoption of mechanization and automation into our production systems.

How do Allied Grape Growers collaborate with other industry stakeholders, such as wineries and government agencies, to address common challenges and advocate for the interests of growers?

Allied Grape Growers is actively involved with many industry boards and task forces to assist and lead in addressing common challenges and be an advocate for growers. Being an integral part of the California Association of Winegrape Growers, which actively advocates and lobbies for the interest of California winegrape growers, is not the least of these. But in addition to sitting on that board for decades, Allied Grape Growers currently has active board seats on the PD/GWSS state board, the California Sustainable Winegrowing Alliance, the Winegrape Inspection Program, the West Coast Smoke Exposure Taskforce, the Agricultural Council of California and numerous other regional wine industry association boards. Through our participation on these numerous boards and task forces, we are a continual voice for the interests of California winegrape growers.

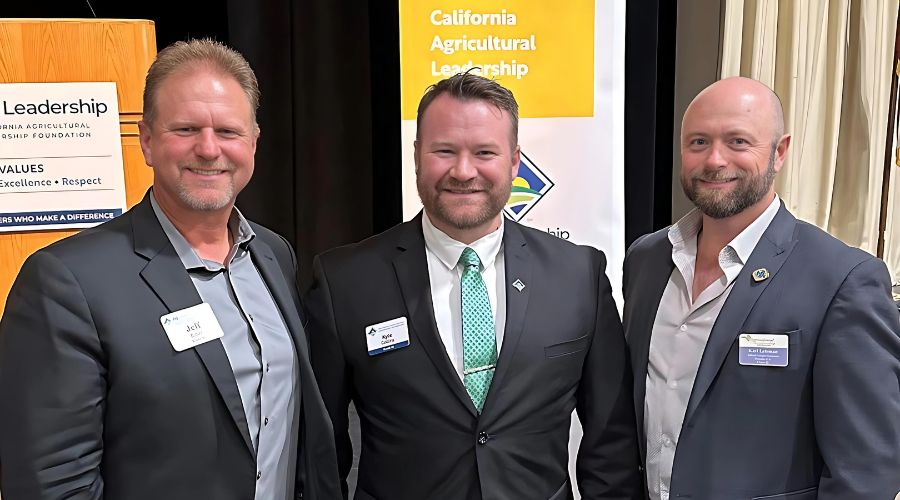

Image: Strong AGG leaders supporting the grape industry. (From L-R) Jeff Bitter, AGG President, Karl Lehman, AGG Director of Central Valley Operations and Kyle Collins, AGG Manager of North Valley Operations.

What advice would you give to winegrape growers in California who are facing market uncertainties and seeking to improve the sustainability of their operations?

The first thing is for a grower to recognize whether or not they truly have a sustainable operation. This includes honestly evaluating the marketability of their fruit based on the variety, region, productivity, and/or quality level. Vineyards are long-term investments, but consumers change regularly. While the wine industry provides some forgiveness due to blending/composition laws, etc. there still becomes a time when ongoing demand can evaporate for certain vineyards. So my advice is to evaluate the market uncertainties in light of various factors such as the age, health, and productivity of the vineyard as well as estimating the likelihood of increased (or restored) demand for the variety or quality produced. Providing that resources are available, it might actually be a good time to re-develop a vineyard, focusing on modernizing trellising; variety, rootstock, and clone selections; and farming practices such as irrigation and fertility management. The bottom line is that it is unlikely any operation will remain sustainable if continual improvement is not engrained in the plan. This is not an industry that allows growers to do the same thing they have always done and remain competitive.

Looking ahead, what are your predictions for the future of the California wine industry, and what role do you see Allied Grape Growers playing in shaping that future?

I believe our industry will remain stable overall, but keep in mind stability doesn’t necessarily mean “growth”. Our industry has to accept that we can find and appreciate success in stability. The notion that the only way to achieve success is to continually grow is probably one that will be challenged in the near future. But regardless of the headwinds that we experience today, there are always opportunities for success. Product innovation and consumer focus are paramount in finding success. Our industry has to focus on appeal. How do we appeal to the consumers in the various demographic and cohort groups? We aren’t selling to one type of consumer. We are selling to various groups of similarly positioned consumers, so understanding our appeal amongst those different groups is critical to our success. I see Allied Grape Growers’ strategy continuing to align with this idea of stability. By providing market information and related grape marketing services, we can continue to facilitate success for growers statewide. Again, this comes down to seeking out opportunities, providing appeal, and executing deliverables.

Image: AGG booth at the Unified Wine Grape Symposium.

Conclusion:

Our conversation with Jeff Bitter highlights the indispensable role of the cooperative model in fostering a stable and prosperous wine industry. By prioritizing the interests of its grower members and maintaining a focus on fair representation and cost-effective marketing, AGG ensures that profits are returned to the growers, fostering a sense of community and shared purpose. This approach not only benefits individual growers but also contributes to the stability and sustainability of the California wine industry as a whole. In an environment marked by shifting consumer preferences and market uncertainties, the cooperative model of AGG offers stability, providing growers with the support and opportunities they need to thrive. As the industry continues to evolve, the cooperative principles upheld by AGG will remain vital in navigating future challenges and sustaining the success of California's winegrape growers.

In conversation with Malvika Patel, Editor and VP, Beverage Trade Network

If you're a bulk wine or bulk spirits supplier, contract bottler, or private label producer aiming to connect with serious trade buyers, IBWSS San Francisco is the event you can't afford to miss. Get a quotation or Book a exhibitor table.